The following is a link to an article published in Forbes right after the last FED meeting on April 29, where Fed Chief Janet Yellen announced the further tapering of quantitative easing from $55B in the month of April to $45B in May.

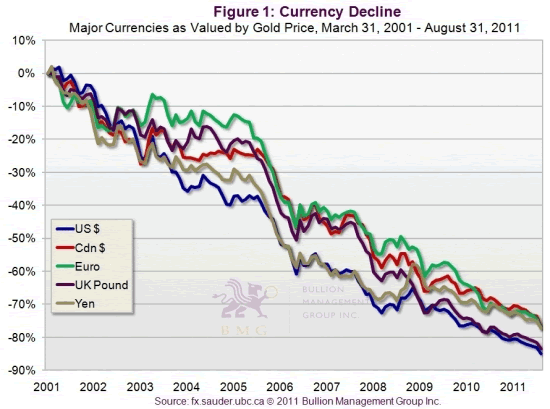

For approximately the last 5 1/2 years until the start of 2014, the Fed has been purchasing US Treasury Bonds, as you know, to the monthly tune of approximately $80B, thereby increasing the number of greenbacks in the money supply and thusly depleting its purchasing power by equal measure. US trading partners around the world have emulated this policy in their own national economies in order to prevent their currencies from overpowering the dollar and adversely affecting exports to the US and throughout the global marketplace. This has led to a global decline of household purchasing power in the developed as well as in emerging economies around the world.

Moreover, the diluted purchasing power of the dollar over the past three years has sent shockwaves through the gold markets. China, Russia, India, Turkey, Philippines, Venezuela and Iran have consistently shown up on the radar over the last three years buying up over 1,000 metric tons in what has amounted to a record in sales volume not seen in over 50 years. Is it a coincidence that some of these countries are not necessarily some of our country's best friends? Conversely, the US, Germany, the U.K. and France have been maintaining an annual policy where each of them have been selling approximately 200 metric tons of gold each year from their respective reserves for the last 22 years in a combined effort to keep gold prices down. Not surprisingly, China, Russia, and India have all announced they are no longer buying US Treasury bonds. After all, they loan us $1.00 today through a bond purchase, and we would repay them with dollars that are worth less in the future. As a result, the largest buyer of US Treasuries is now the Federal Reserve of the United States. Talks have been going on for over a year now to replace the US dollar as the world's reserve currency, with China, Russia and India leading the charge to abandon the greenback in exchange for a global unit of exchange that offers greater stability.

This has also been seen in major real estate markets around the world. Purchases of hard assets like real estate, gold, art and collectibles, etc. have all seen considerable growth in recent years by institutional investors. Currently, Miami real estate leads the nation in cash purchases with 62% of all purchases being made in cash.

It is beyond my ability to predict the future of the US dollar in terms of its status as the world's reserve currency. However, I do believe if the FED reduces and eventually ends the QE policy, interest rates will likely rise over time and this will invariably affect property values. According to Janet Yellen, the end to QE will probably take place around the end of 2014, and interest rates should begin to increase within a few months afterwards.

I urge both buyers and sellers to do their own homework and based on the findings they obtain, plan their real estate sales and purchases over the next year accordingly.